In an attempt to further punish Massachusetts’s beleaguered gun owners, on January 20, Massachusetts State Senator Cynthia S. Creem filed SD.1884.

The legislation includes a raft of gun control measures, not the least

of which is a 4.75 percent “sin tax” on all lawful firearms-related

activity.

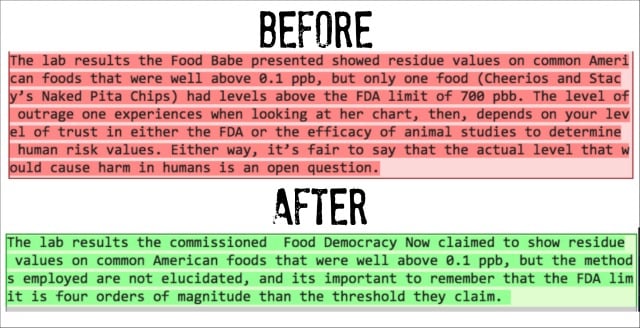

SD.1884 requires, “an additional

surcharge of 4.75 percent shall be imposed on sales at retail of all

ammunition, rifles, shotguns, firearms or parts thereof.” Contemplating

that law-abiding gun owners would seek to avoid this surcharge by

purchasing goods in neighboring states, the legislation also makes

clear, “an additional surcharge of 4.75 percent shall be imposed on the

storage, use or other consumption of ammunition, rifles, shotguns,

firearms or parts thereof… purchased from any vendor or manufactured,

fabricated or assembled from materials acquired either within or outside

the commonwealth for storage, use or consumption within the

commonwealth.”

Massachusetts already has a sales and use

tax of 6.25 percent. Therefore, a Massachusetts gun owner would be

subject to an 11 percent state tax on the purchase of firearms,

ammunition, and related accessories. All gun owners are already subject

to an 11 percent federal excise tax on firearms and ammunition under the

Pittman-Robertson Act. The mere idea of a 22 percent tax on the

exercise of the Second Amendment right to keep and bear arms is shameful

in a state so critical to the founding of this great nation.

Of course, the Pittman-Robertson 11

percent federal excise tax on firearms and ammunition is for the benefit

of the shooting sports, and is used to provide hunting and shooting

opportunities for all Americans. Conversely, the surcharge imposed by

SD.1884, would be used to fund a “Firearms Violence Prevention Trust

Fund,” which state officials would employ to “establish an annual

municipal grant program to support municipal violence prevention

programs.” It does not take a pessimist to imagine how, under the

stewardship of the Massachusetts state government, such a fund might

devolve into a vehicle under which the state’s gun owners would be

forced to directly finance the abrogation of their own rights.

In explaining her tax to the Salem News,

Creem likened the exercise of the constitutional right to keep and bear

arms to tobacco use, noting, “It's like the tobacco tax, which is used

for smoking cessation programs.” Creem added, “To me, it's the same

thing as paying a toll on the bridge for using the roads.”

Creem’s defense of her legislation has been disjointed. At one point she told Wicked Local Newsbank,

“I look at this as a way to still enjoy the lawful use of firearms.”

However, at another she admitted that her intent with SD.1884 is to

curtail both legal and illegal gun ownership, stating, “I've filed gun

legislation every session. I want to make it harder and harder to get

guns in and get guns into the hands of people who shouldn't have them.”

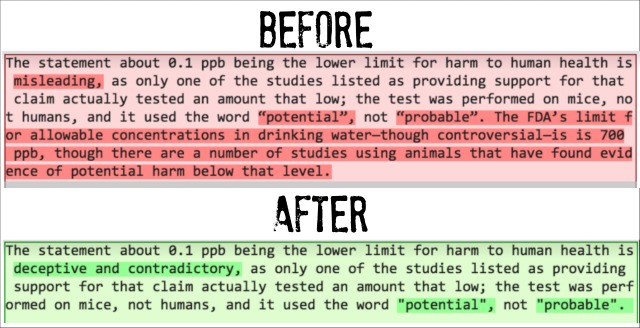

As an attorney, Creem should know that

the U.S. Supreme Court has frowned upon attempts to curtail

constitutionally-protected behavior through targeted taxation. In Minneapolis Star Tribune Co. v. Minnesota Commissioner of Revenue,

the Court held that a Minnesota use tax on paper and ink used in

publishing violated the First Amendment. The Court explained, “A power

to tax differentially, as opposed to a power to tax generally, gives a

government a powerful weapon against the taxpayer selected.”

The Court came to this decision despite

the fact that there was “no legislative history and no indication, apart

from the structure of the tax itself, of any impermissible or censorial

motive on the part of the legislature.” With SD.1884, Creem has been

explicit about her motive of reducing lawful gun ownership.

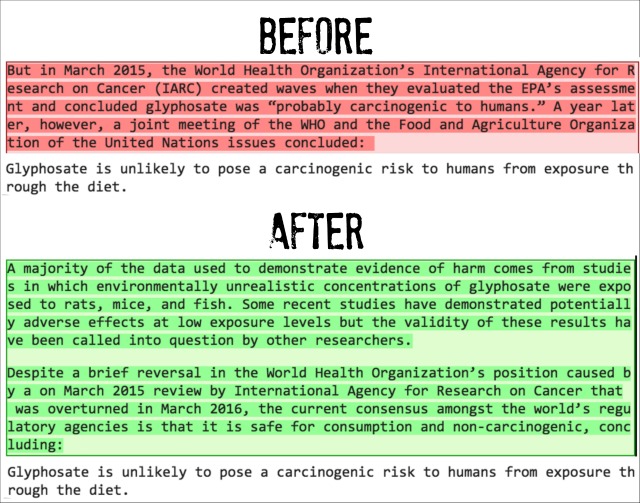

And that is all that Creem could hope to

accomplish with her tax, as criminals procure firearms outside the

normal stream of commerce. A Department of Justice survey

of state prison inmates found that the overwhelming majority (nearly 80

percent) obtained firearms through a “street/illegal source” or through

“family or friend[s].” Drug dealers and armed robbers don’t typically

file 1040s, and any firearm sales or use tax can expect a similar level

of underworld compliance.

Moreover, such taxes wouldn’t affect

criminal firearm use even in the unlikely event that the criminal

element subjected themselves to it. In his widely-celebrated 1994 essay

for the Atlantic Monthly, titled, “The False Promise of Gun Control,”

George Mason University School of Law Professor Daniel D. Polsby

pointed out that criminals are the least likely segment of the

population to be affected by gun controls that raise the cost of

firearms ownership.

Polsby noted,

Where

people differ is in how likely it is that they will be involved in a

situation in which a gun will be valuable. Someone who intends to engage

in a transaction involving a gun—a criminal, for example—is obviously

in the best possible position to predict that likelihood. Criminals

should therefore be willing to pay more for a weapon than most other

people would… The class of people we wish to deprive of guns, then, is

the very class with the most inelastic demand for them—criminals—whereas

the people most likely to comply with gun control laws don’t value guns

in the first place.

Of course, all gun controls in some

manner raise the cost of lawful firearm ownership, with taxation of

firearms and ammunition merely being one of the more direct and visible

methods. As for less direct - but even more substantial - costs, Creem’s

legislation provides several.

The bill would require gun owners to

conduct all firearm transfers through a licensed dealer pursuant to a

background check. Massachusetts gun owners are already required to

obtain a Firearms Identification Card, which is issued only after the

applicant has been found to have met the state’s onerous licensing requirements and passed a background check.

The legislation also imposes a “smart

gun” mandate on future handgun sales. The bill requires that in six

months from “commercial availability” of handguns “equipped with

personalized firearm technology,” the state’s approved handgun roster

shall not include “any newly manufactured” handguns that are not

equipped with such technology. The more intelligent gun control

advocates have abandoned this approach, contending that a similar New Jersey mandate has stifled development of this technology.

SD.1884 would make it unlawful to “sell,

purchase, rent, lease or possess a .50 BMG rifle or .50 BMG cartridge.”

To justify the proposed ban, Creem relied on her feelings, telling a

media outlet, “I can't see a credible reason why a civilian needs that

kind of firearm.” The proposal prompted the Massachusetts Gun Owners

Action League’s Jim Wallace to point out that .50-caliber rifles are

often used in the shooting sports, and ask, “Has there ever been a crime

committed with a .50 caliber firearm in Massachusetts? What's the

problem we're trying to solve?”

This is apt question, given that crime

committed using rifles is exceedingly rare in Massachusetts and the rest

of the country. In 2014 and 2015

a total of one homicide was committed using a rifle of any kind in

Massachusetts. Unfortunately, these figures have not deterred Creem from

pursuing her legislation, and did not deter Massachusetts Attorney

General Maura Healey from perverting existing state law to ban several types of commonly-owned rifles in 2016.

In recent years, gun control advocates

have taken to describing nearly every proposed restriction, as “common

sense.” In describing her bill, Creem told a reporter, “Some of these

are just common-sense thoughts.” Gun control advocates should take issue

with Creem’s use of this rhetoric. Using this language in an attempt to

conceal the aims of such an uncommonly senseless piece of legislation

threatens the little remaining credibility of broader movement’s carefully orchestrated messaging efforts.